In Double-Entry Accounting, there are at least two sides to every financial transaction. Every accounting entry has an opposite corresponding entry in a different account. This principle ensures that the Accounting Equation stays balanced.

Impact of transactions on accounting equation

The cash flow statement is generated in bookkeeping from information on the balance sheet. It gives a more detailed account of how a firm manages its cash and CCE’s through its operating, financing, and investing activities. In above example, we have observed the impact of twelve different transactions on accounting equation. Notice that each transaction changes the dollar value of at least one of the basic elements of equation (i.e., assets, liabilities and owner’s equity) but the equation as a whole does not lose its balance. In contrast, the income and cash flow statements reflect a company’s operations for its whole fiscal year—365 days. This practice is referred to as “averaging,” and involves taking the year-end (2023 and 2024) figures—let’s say for total assets—and adding them together, then dividing the total by two.

What’s the difference between a balance sheet and a cash flow statement?

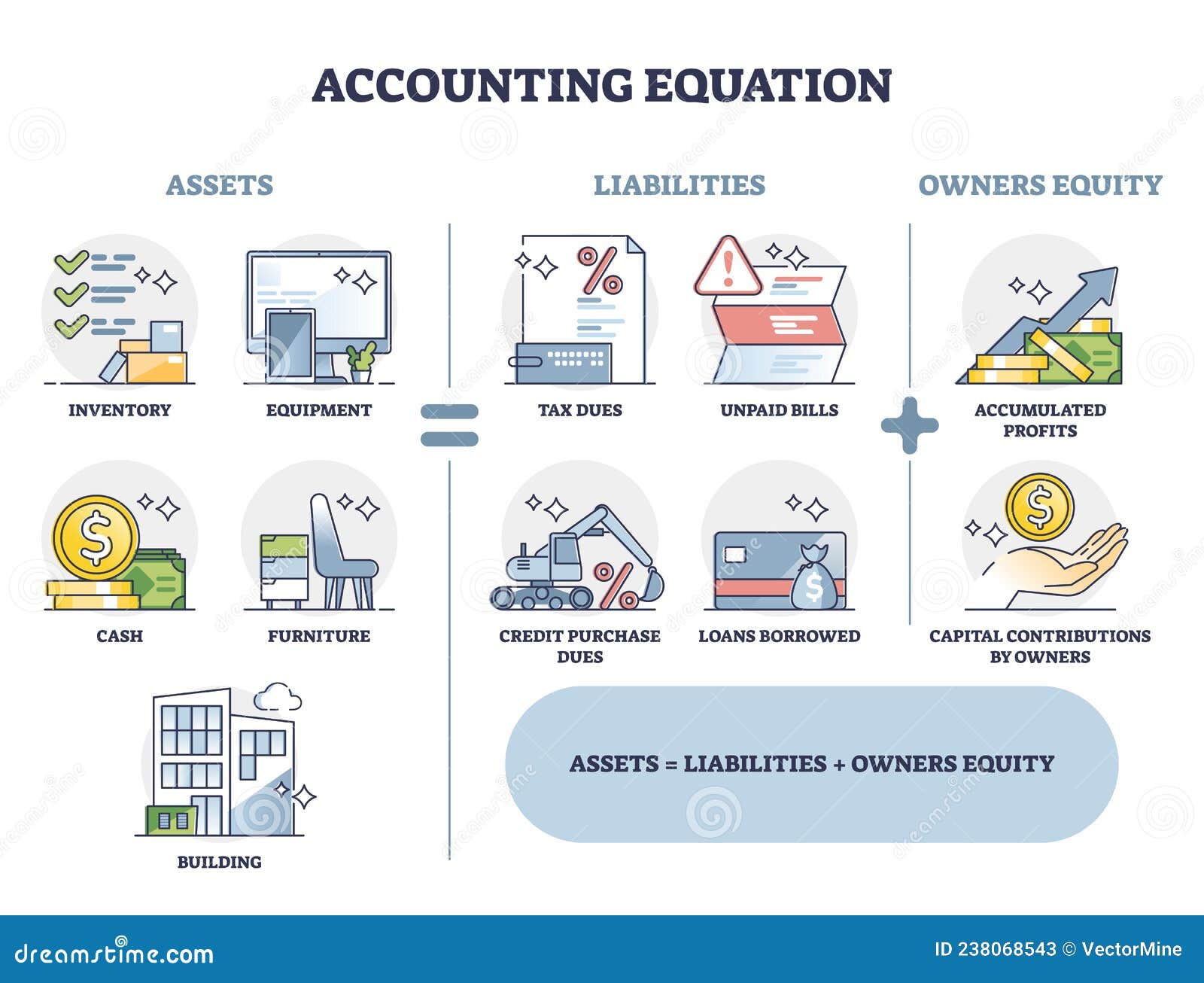

So whatever the worth of assets and liabilities of a business are, the owners’ equity will always be the remaining amount (total assets MINUS total liabilities) that keeps the accounting equation in balance. The accounting equation is based on the premise that the sum of a company’s assets is equal to its total liabilities and shareholders’ equity. As a core concept in modern accounting, this what forms a good business team provides the basis for keeping a company’s books balanced across a given accounting cycle. As you can see, no matter what the transaction is, the accounting equation will always balance because each transaction has a dual aspect. The purpose of this article is to consider the fundamentals of the accounting equation and to demonstrate how it works when applied to various transactions.

Does the Balance Sheet Always Balance?

We briefly go through commonly found line items under Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity. The accounting equation is continually updated on a balance sheet. A balance sheet is like a snapshot of assets, liabilities, and equity in a single slice of time. If you were to add up all of the resources a business owns (the assets) and subtract all of the claims from third parties (the liabilities), the residual leftover is the owners’ equity. While an asset is something a company owns, a liability is something it owes. Liabilities are financial and legal obligations to pay an amount of money to a debtor, which is why they’re typically tallied as negatives (-) in a balance sheet.

Importance of a Balance Sheet

- Lastly, there is little standardization of account nomenclature.

- Before explaining what this means and why the accounting equation should always balance, let’s review the meaning of the terms assets, liabilities, and owners’ equity.

- The purpose of this article is to consider the fundamentals of the accounting equation and to demonstrate how it works when applied to various transactions.

- The major and often largest value assets of most companies are that company’s machinery, buildings, and property.

- Without context, a comparative point, knowledge of its previous cash balance, and an understanding of industry operating demands, knowing how much cash on hand a company has yields limited value.

All assets owned by a business are acquired with the funds supplied either by creditors or by owner(s). In other words, we can say that the value of assets in a business is always equal to the sum of the value of liabilities and owner’s equity. The total dollar amounts of two sides of accounting equation are always equal because they represent two different views of the same thing. There are three main ways to analyze the investment-quality of a company through its balance sheet.

HBS Online does not use race, gender, ethnicity, or any protected class as criteria for admissions for any HBS Online program. Updates to your enrollment status will be shown on your account page. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program. We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners. To make the Accounting Equation topic even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our accounting equation visual tutorial, cheat sheet, flashcards, quick test, and more.

Assets will typically be presented as individual line items, such as the examples above. Then, current and fixed assets are subtotaled and finally totaled together. If an accounting equation does not balance, it means that the accounting transactions are not properly recorded. This is how the accounting equation of Laura’s business looks like after incorporating the effects of all transactions at the end of month 1.

The balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’ equity. If the left side of the accounting equation (total assets) increases or decreases, the right side (liabilities and equity) also changes in the same direction to balance the equation. The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity. While a company’s balance sheet records cash entries, it can’t track cash flow.

Liabilities are what a company owes, such as taxes, payables, salaries, and debt. The shareholders’ equity section displays the company’s retained earnings and the capital that has been contributed by shareholders. For the balance sheet to balance, total assets should equal the total of liabilities and shareholders’ equity.

Leave A Comment