You cannot begin to configure predictive analytics without base numbers first. The accounts receivable turnover ratio is an important assumption for driving a balance sheet forecast and making accurate financial predictions. Ron Harris runs a local yard service for homeowners and few small apartment complexes. He is always short-handed and overworked, so he invoices customers whenever he can grab a free hour or two. Even though Ron’s customers generally pay on time, his accounts receivable ratio is 3.33 because of sporadic invoicing and irregular invoice due dates.

What is the accounts receivable turnover ratio?

By knowing how quickly your invoices are generally paid, you can plan more strategically because you will have a better handle on what your future cash flow will be. But it may also make him struggle if his credit policies are too tight during an economic downturn, or if a competitor accepts more insurance providers or offers deep discounts for cash payments. Every company sells a product and/or service, invoices for the same, and collects payment according to the terms set forth in the sale. If a company is too conservative in extending credit, it may lose sales to competitors or incur a sharp drop in sales when the economy slows.

How is accounts receivable turnover in days calculated?

This is where poor AR management can also affect your accounts payable functions. A low accounts receivable turnover ratio, on the other hand, often indicates that the credit policies of the business are too loose. For example, you may allow a longer period of time for clients to pay or not enforce late fees once your deadline to pay has passed. For example, the accounts receivable turnover ratio is one of the metrics that business investors and lenders look at when determining whether to invest in or loan money to your business. Investors and lenders want to see receivables turnover ratios similar or slightly higher than other businesses in your industry. A higher accounts receivable turnover ratio is desirable since it indicates a shorter delay between credit sales and cash received.

Rare American Coins That Are Worth a Lot of Money

Like some other activity ratios, receivables turnover ratio is expressed in times like 5 times per quarter or 12 times per year etc. When it comes to business accounting, there are many formulas and calculations that, although seemingly complex, can nevertheless provide valuable insight into your business operations and financials. One such calculation, the accounts receivable turnover ratio, can help you determine how effective you are at best accounting software of 2021 extending credit and collecting debts from your customers. Accounts receivable turnover ratio calculations will widely vary from industry to industry. That’s because it may be due to an inadequate collection process, bad credit policies, or customers that are not financially viable or creditworthy. A low turnover ratio typically implies that the company should reassess its credit policies to ensure the timely collection of its receivables.

However, a ratio of less than 10 is generally considered to be indicative of a company having Collection problems. Now that you understand what an accounts receivable turnover ratio is and how to calculate it, let’s take a look at an example. A low ratio may also indicate that your business has subpar collection processes. On the other hand, it could also be that your collection staff members are not receiving the training they need or are not assertive enough when following up on unpaid invoices. Average accounts receivable is used to calculate the average amount of your outstanding invoices paid over a specific period of time. In this guide, we’ll break down everything you need to know about what a receivables turnover ratio is, how to calculate it, and how you can use it to improve your business.

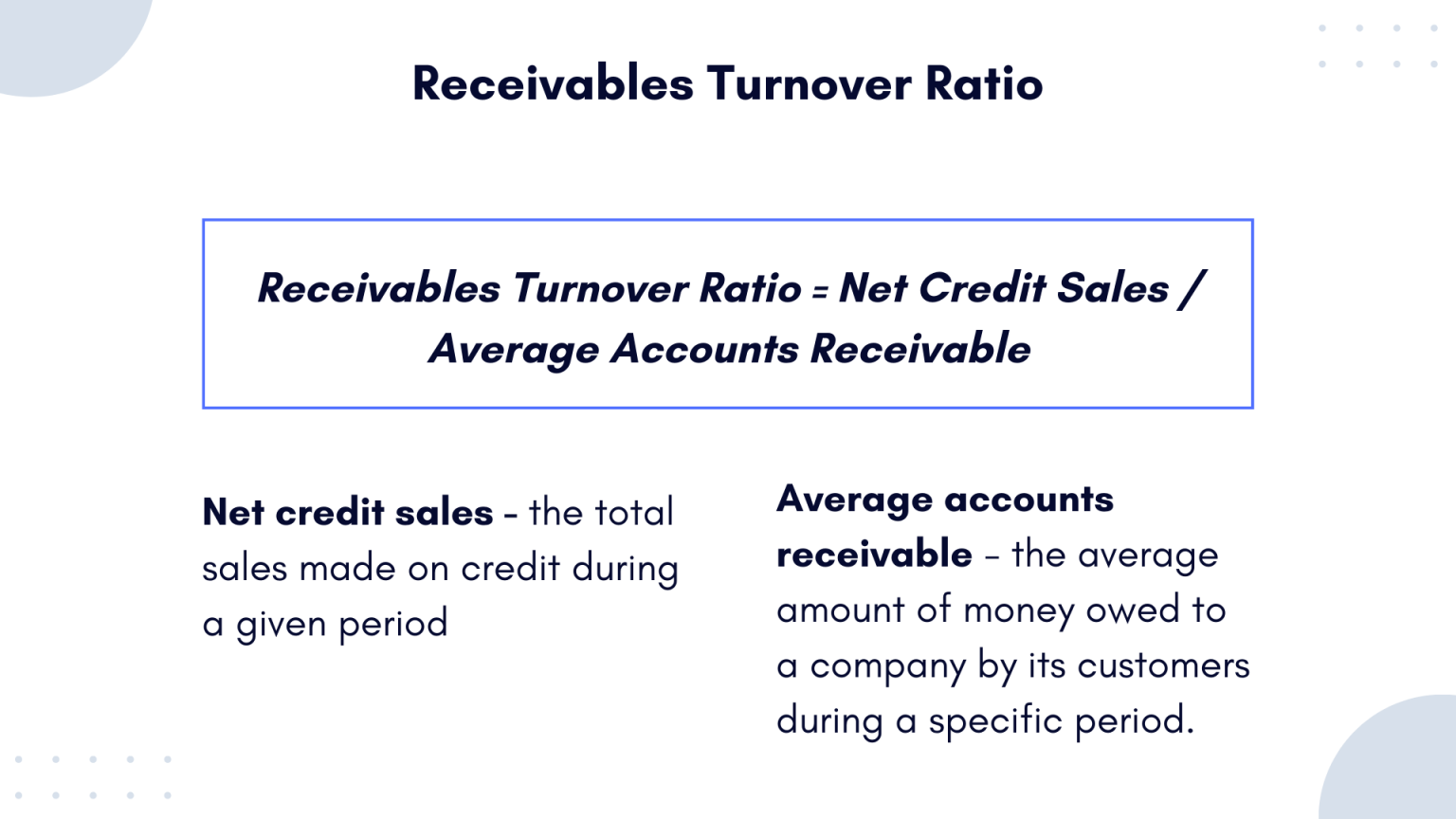

What formula is used to calculate the accounts receivable turnover ratio?

- A low turnover ratio typically implies that the company should reassess its credit policies to ensure the timely collection of its receivables.

- Tracking the turnover over time can help you improve your collection processes and forecast your future cash flow.

- The year-over-year growth formula is one of the most reliable ways of tracking your long-term growth.

- By regularly reviewing their credit policies, companies can ensure that they extend credit wisely, fostering customer relationships while protecting their financial interests.

Once you know how old your outstanding invoices are, you can work on it accordingly to increase revenue from them or also make a note of those who haven’t paid yet for further follow-ups. This is the most common and vital step towards increasing the receivable turnover ratio. Using the accounts receivable turnover calculator is one thing and understanding the data coming out of it is completely another ball game altogether.

The total sales have little effect on this issue and the AR ratio is at a low 3.2 due to sporadic invoices and due dates. This means, the AR is only turning into bankable cash 3 times a year, or invoices are getting paid on average every four months. An asset turnover ratio measures the efficiency of a company’s use of its assets to generate revenue. The accounts receivables ratio, on the other hand, measures a company’s efficiency in collecting money owed to it by customers.

With certain types of business, such as any that operate primarily with cash sales, high receivables turnover ratio may not necessarily point to business health. You may simply end up with a high ratio because the small percentage of your customers you extend credit to are good at paying on time. In other words, your business is proficient in collecting, and the clients pay on time. A higher income statement or balance sheet, a balanced asset turnover, and even greater creditworthiness for the organization are further factors that many can cite.

Since sales returns and sales allowances are outflows of cash, both are subtracted from total credit sales. Furthermore, accounts receivables can vary throughout the year, which means your ratio can be skewed simply based on the start and endpoint of your average. Therefore, you should also look at accounts receivables aging to ensure your ratio is an accurate picture of your customers’ payment. So, now that we’ve explained how to calculate the accounts receivable turnover ratio, let’s explore what this ratio can mean for your business. In this guide, therefore, we’ll break down the accounts receivable turnover ratio, discussing what it is, how to calculate it, and what it can mean for your business. Credit policies must strike a balance between expanding the customer base and minimizing the risk of non-payment.

Net sales is everything left over after returns, sales on credit, and sales allowances are subtracted. Your ratio highlights overall customer payment trends, but it can’t tell you which customers are headed for bankruptcy or leaving you for a competitor. With Bench at your side, you’ll have the meticulous books, financial statements, and data you’ll need to play the long game with your business. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

The accounts receivable turnover ratio, or debtor’s turnover ratio, measures how efficiently a company collects revenue. Your efficiency ratio is the average number of times that your company collects accounts receivable throughout the year. An average accounts receivable turnover ratio of 12 means that your company collects its receivables 12 times per year or every 30 days. The accounts receivable turnover ratio is a simple metric used to measure a business’s effectiveness at collecting debt and extending credit. It is calculated by dividing net credit sales by average accounts receivable. The accounts receivable turnover ratio, also known as receivables turnover, is a simple formula that calculates how quickly your customers or clients pay you the money they owe.

Leave A Comment