The analysis compares line items from the same financial statement in different periods to identify whether there have been increases or decreases in the figures. The analysis can be conducted on both the income statement and the balance sheet, comparing the figures for multiple years or quarters. While analyzing financial statements, horizontal analysis is used to analyze historical data from various accounting periods, such as ratios or line items. In a horizontal analysis, comparisons can be done using either absolute comparisons or percentage comparisons. In the latter case, the statistics from each succeeding period are expressed as a percentage of the baseline year’s total, with 100% serving as the baseline value.

Get in Touch With a Financial Advisor

Vertical and horizontal analyses are both tools for financial statement analysis, but they differ in purpose. Since we do not have any further information about the segments, we will project the future sales of Colgate based on this available data. In the current year, company XYZ reported a net income of $20 million and retained earnings of $52 million.

- Above, you are presented a comparative retained earning statement for the years 2020 and 2021.

- An analysis of the income statement, balance sheet, and cash flow statement over time gives a complete picture of operational results and reveals what is driving a company’s performance and whether it is operating efficiently and profitably.

- This makes it easier to spot inefficiencies and specific areas of underperformance.

How to Automate Financial Reports The Easy Way

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on topic no 458 educator expense deduction 2020 a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. The investor now needs to make a decision based on their analysis of the figures, as well as a comparison to other similar figures.

Step 3 of 3

Below is the calculation for revenue that increased from Rs. 100,000 in 2017 to Rs. 150,000 in 2018. Mike Dion brings a wealth of knowledge in business finance to his writing, drawing on his background as a Senior FP&A Leader. Over more than a decade of finance experience, Mike has added tens of millions of dollars to businesses from the Fortune 100 to startups and from Entertainment to Telecom. Mike received his Bachelor of Science in Finance and a Master of International Business from the University of Florida, laying a solid foundation for his career in finance and accounting. His work, featured in leading finance publications such as Seeking Alpha, serves as a resource for industry professionals seeking to navigate the complexities of corporate finance, small business finance, and finance software with ease. We’re diving into some real-life examples that’ll make horizontal analysis as easy as pie—or at least easier than understanding your phone bill.

Welcome to F9 Finance!

First, a direction comparison simply looks at the results from one period and comparing it to another. For example, the total company-wide revenue last quarter might have been $75 million, while the total company-wide revenue this quarter might be $85 million. This type of comparison is most often used to spot high-level, easily identifiable differences. By looking at the numbers provided by a company, you should see whether there are any large differences between one year and the next. It is also possible to perform this analysis with time series data to make direct comparisons with other companies.

Horizontal Analysis and Variances

However, having these statements alone and just looking at the figures does not help you by itself to improve your financial situation. Through horizontal analysis, the different items can be seen to have different increases and decreases, with each item only compared with its corresponding counterpart in the alternate balance sheet. Direct comparison simply involves directly comparing the results, usually revenue, of two accounting periods. A trend is then determined and the level and quality of details you obtain from your financial statements depend on the software or accounting technique you use.

They are also in a position to determine growth patterns and trends, such as seasonality. The method also enables the analysis of relative changes in different product lines and projections into the future. Another method of horizontal analysis is calculating the variance between multiple financial items in multiple financial statements and spanning multiple accounting periods. One way to perform a horizontal analysis is to compare the absolute currency amounts of some items over time.

Based on historical data, a horizontal analysis interprets the change in financial statements over two or more accounting periods. It denotes the percentage change in the same line item of the next accounting period compared to the value of the baseline accounting period. Horizontal analysis of Wipro’s financial statements over two years provides insights into the company’s changing financial performance. While revenues declined slightly, Wipro improved gross profit margins and operational cash flows, indicating effective financial management despite a marginal drop in overall profitability. Secondly, in the second type of horizontal analysis, we are interested in knowing about the underlying trends in the line items of the income statement.

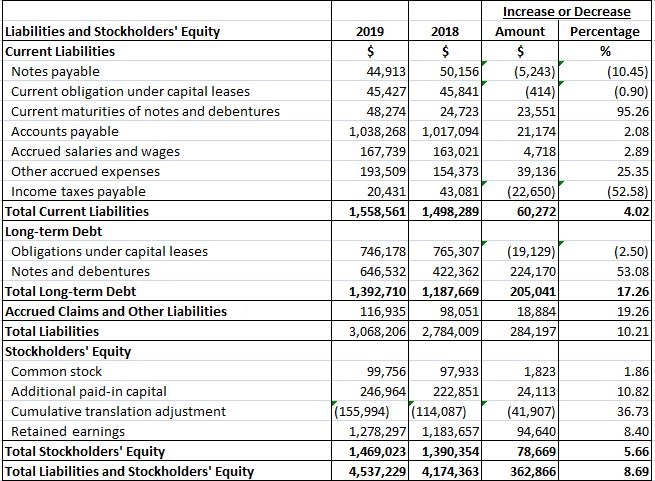

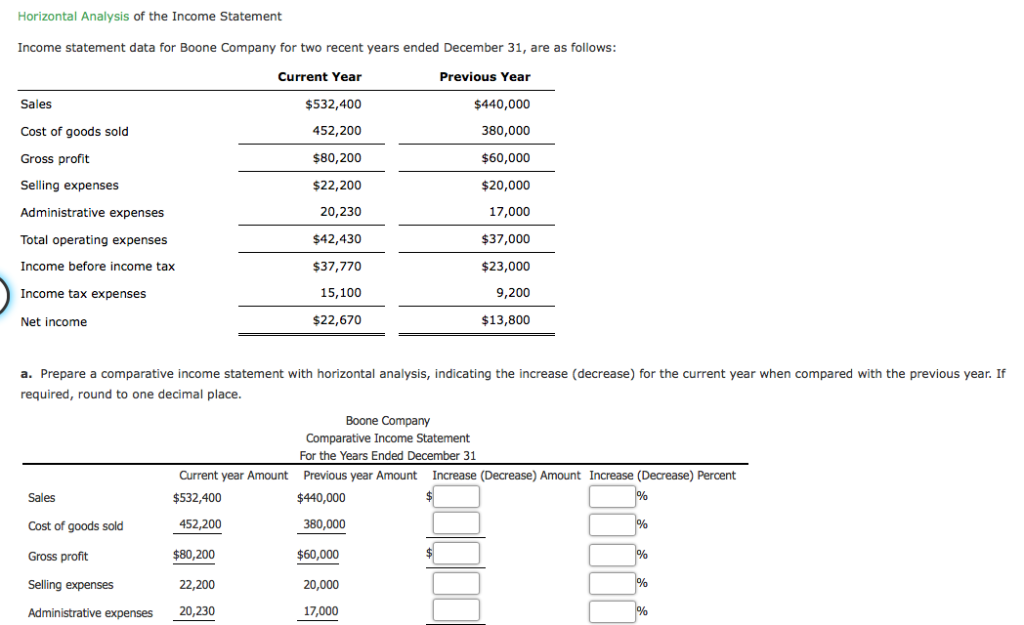

Subsequently, calculate the dollar change by subtracting the value in the base year from that in the comparison year and divide by the base year. For more detailed representations of how horizontal analysis really works, here are a few examples with balance sheets, income statements, and retained earnings. Users of financial statements can quickly see trends and growth patterns thanks to horizontal analysis. Horizontal analysis provides insight into the direction in which a company’s financial data is moving. For example, we perform a horizontal analysis on the balance sheet of Wipro, an Indian information technology company.

Leave A Comment